Governance

ESG Governance

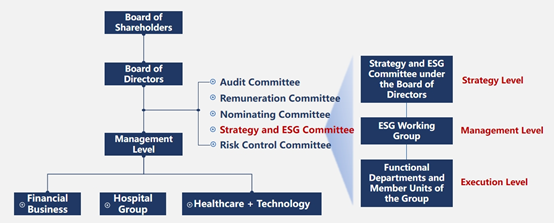

ESG Governance Structure

In order to further ensure that the relevant matters are carried out in a systematic and orderly manner within the Group and at all levels of its organizations, the Group has established an ESG governance framework under the joint decision-making of the Board of Directors and the senior management, integrating environmental, social and governance considerations into the decision-making and planning of every operation and business level, so as to comprehensively promote the sustainable development process of the Group.

Universal Medical has established a Strategy and ESG Committee to conduct research on the Group's medium-to-long-term development strategies (including sustainability strategies) and their feasibility. Concurrently, the Committee ensures the effectiveness of management and decision-making mechanisms for key issues, participating in the formulation of policies, strategies, guidelines, and objectives related to significant topics that impact the Group's sustainable development, such as climate change risks and opportunities, privacy and data security, inclusive finance, occupational health and safety, anti-corruption and anti-bribery, etc. It also conducts regular (annual) discussions and reviews of these key issues, monitors progress and performance, and, where appropriate, makes suggestions to the Board of Directors.

Additionally, we have established an ESG Working Group, a special committee under the oversight of the management level. This group is composed of representatives from the functional departments within our Group that are involved in ESG matters.The Chief Accounting Officer (CAO) serves as the dedicated person in charge of sustainability issues.The ESG director serves as the leader of the working group. The group reports on ESG matters to the Strategy and ESG Committee under the Board of Directors and, when necessary, provides relevant feedback to management or the appropriate departments. The daily work department of the ESG working group is the Board Office.

The ESG Working Group is authorized by the committee under the Board of Directors to participate in the ESG-related work of Universal Medical. Its responsibilities include coordinating and harmonizing the implementation and execution of all ESG-related work by the functional departments of the Group's headquarter and subsidiaries, reporting regularly to the Board of Directors on major ESG issues and work, communicating the Group's strategies and specific initiatives on ESG management, collecting and reporting on the ESG management measures and performance, and collecting the required data for ESG reports from the functional departments of the Group for submission to the Board of Directors for approval. The ESG Working Group will formulate recommendations to the Board members and its committee members for improvement in light of the actual situation of ESG related work, so that the Board can carry out ESG oversight in a sustainable and effective manner.

Each functional department and its ESG director are responsible for the management of each specific ESG issue, data collection and promotion of important ESG practices, and carry out related work in accordance with the ESG management system and processes.

The Group conducts regular comprehensive reviews of its ESG governance framework, inviting internal and external experts and stakeholder representatives to participate in evaluations. These reviews benchmark industry best practices and analyze the Group’s strengths and weaknesses. Identified issues are addressed through targeted improvement measures, continuously optimizing sustainability practices and plans to enhance the Group’s sustainable development management capabilities.

Responsibilities of the Board of Directors

The Group has formulated the Rules of Procedure for the Board of Directors, which stipulates that directors must perform their duties in accordance with applicable national laws, regulations, normative documents, the Articles of Association, and other relevant provisions. Directors' personal liabilities are limited to the scope permitted by national laws. Except for executive directors, the Group implements rotational retirement of directors at each annual general meeting. One-third of the directors (or the nearest number not less than one-third) in office at that time must retire by rotation, and the retiring directors will be re-elected. The Group has formulated a succession plan for members of the board of directors and key senior management (including the CEO). Suitable candidates are jointly recommended by the board of directors and the shareholders' meeting, and the results of the board's performance evaluation are used as a reference for nominating director successors. To formulate the succession plan, we focus on the following qualities of directors and senior executives (including the CEO):

1. Possessing excellent professional capabilities and management skills;

2. Aligning values with the Group’s Philosophy;

3. Having core qualities such as integrity, pragmatism, innovation, and a sense of corporate responsibility.

To ensure the effective implementation of the Board's responsibilities, the Group stipulates that any amendment to the Articles of Association must be approved in writing by shareholders holding not less than 75% of the total voting rights of the relevant class of shares, or approved by a special resolution at a meeting of the holders of that class of shares. No amendments may be made through other means. This arrangement ensures that the procedure for amending the Articles of Association is rigorous and legal, and enables prudent decision-making on major matters with full shareholder participation.

Variable Remuneration System for Senior Executives

The Group implements a variable remuneration arrangement for the Chief Executive Officer and other senior executives, which is linked to the results of their term-based performance assessments. The amount of variable remuneration is determined after the end of the term based on the performance assessment results during the performance period (usually covering the entire term). Depending on the Group's actual ability to pay remuneration, it may be paid in a lump sum or in installments according to an agreed vesting schedule, with the maximum payment period not exceeding three years. This mechanism closely links bonus payments to term performance and forms a deferred payment arrangement.

To strengthen incentive constraints and effective management, the Group has established a bonus recovery clause: If it is found that there are cases of illegal payment of remuneration, false reporting or concealment, premature payment of performance remuneration without approval, falsification of remuneration records, or violations of party discipline and government regulations resulting in organizational or economic sanctions during or after the payment period, the Group will recover the already paid performance annual salary, term incentives, or other related income in accordance with laws and regulations. This ensures the integrity and effectiveness of the variable remuneration system and better aligns the interests of management with the long-term interests of shareholders.

- Previous:

- Next: Risk Control and Compliance

Official Wechat Account

Official Wechat Account Offical Weibo Account

Offical Weibo Account